Shield Client Portfolios from Major Drawdowns While You Focus on Growth

A rules-based system that safeguards client portfolios from bear markets and signals when to add exposure during healthy pullbacks without constant monitoring or emotional decision-making.

Learn how Defender helps you save time while enhancing and protecting portfolios—deepening client trust and strengthening relationships.

📅 Schedule Your Demo

The Challenge

Your clients expect you to navigate every meaningful market turn, but staying ahead of each shift is impossible, and emotional decisions often destroy long-term returns.

The Solution

Defender provides objective, historically validated signals that help you reduce client equity exposure before major drawdowns, without guesswork or overreaction.

What Defender Does for Your Practice

-

Systematic Risk Management – Removes emotion with objective buy/sell signals.

-

Client Retention & Alpha – Historically reduced bear market losses by 60% and delivered 5x S&P 500 returns with 30% less volatility.

-

Time & Cost Savings – Institutional-grade risk management without institutional fees; no constant monitoring required.

The Track Record Your Clients Want to See

| 36-Year History | 60% Smaller Losses | 5x S&P 500 Returns |

|---|---|---|

| 1988–2024 signals validated across multiple market cycles | Median bear market losses reduced by nearly 60% | $1M → $88M+ with Defender signals vs. ~$19M buy-and-hold |

✨ 2024 Live Performance: +24.92% return (no signals triggered in the ongoing bull market)

✨ 2025 Live Performance: Defender has closely tracked the S&P 500 while limiting the February-April drawdown to 8.7% vs. 18.9% for the S&P 500.

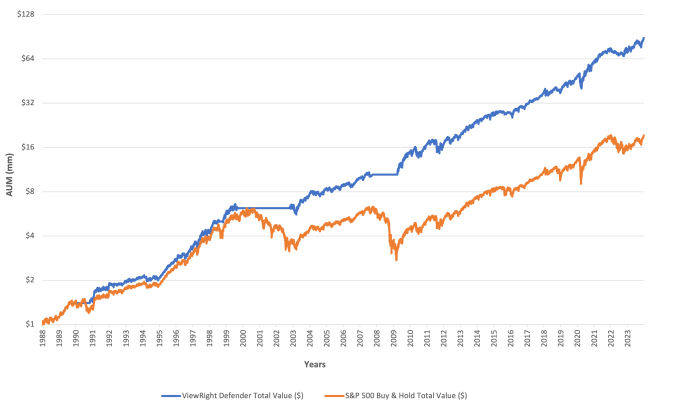

📈 Historical Growth of $1M Since 1988

Comparative Growth of $1,000,000

-

Blue Line: Defender Program S&P 500

-

Orange Line: S&P 500 Total Return

-

Defender has historically delivered 5x the cumulative return of the S&P 500 with 30% less volatility — helping investors compound steadily through multiple market cycles.

How It Works for Wealth Managers

-

Monitor – Defender tracks market breadth and momentum across U.S. equities.

-

Protect – Signals alert you to reduce client equity exposure when conditions weaken.

-

Invest Early – Tactical buy signals indicate when to add exposure during healthy pullbacks.

Works with any U.S. equity-correlated portfolio. Optional beta adjustment available for customized risk control.

Systematic. Directive. Historically Validated.

ViewRight’s Defender Program delivers an equity sub-advisor’s time-savings and risk-adjusted alpha — for a fraction of the cost.

| Comparison | Traditional Sub-Advisor | Defender Program |

|---|---|---|

| Pricing Model | 30 bps on AUM | Flat $7,200 annual fee |

| Cost on $25M AUM | $75,000 / year | $7,200 / year |

| Cost on $50M AUM | $150,000 / year | $7,200 / year |

| Cost on $100M AUM | $300,000 / year | $7,200 / year |

| Risk Management | Varies by manager | Quantitatively adaptive |

| Equity Exposure Adjustments | Discretionary | Signal-based, includes tactical adds during pullbacks |

| Transparency | Limited visibility | Clear, rules-based process |

💡 Savings Example: Advisor managing $50M saves $140,000+ annually versus traditional sub-advisory fees.

Learn how Defender helps you save time while enhancing and protecting portfolios—deepening client trust and strengthening relationships.

📅 Schedule Your 15-Minute Demo

Strategic Market Defense: Unemotional, Precision Investing

The Defender Program is unemotional at moments when human behavior may inspire the opposite.

Defender is correlated when you want it (uptrends) and uncorrelated when you need it (downtrends).

Our process targets high-probability outcomes, generating few signals that align with major market momentum shifts, either just before or after they occur.

Extensively tested on the S&P 500 and other major indexes, the Defender Program adapts seamlessly to any U.S. market-correlated portfolio, with optional beta adjustment for tailored risk management.

Weather Any Conditions With Our Adaptive Equity Allocation System

The distinct market regimes are analogous to the seasons.

Gaining clarity on the current stage of the investment cycle strengthens conviction when allocating substantial capital to the equity market.

Essential Manager Insights

Your Foundation for Confident Portfolio Decisions

Premium Manager Insights

Customized Guidance for a Competitive Edge

Elite Manager Insights

Strategic Partnership for Peak Performance